For sure property with extra extended manufacturing durations, those phase-downs were delayed by one year. For example, a 60% bonus depreciation price applies to long-production-period property positioned in service between January 1 and January 19, 2025. Taxpayers also wants to remember that QIP, up to date in 2017 beneath the TCJA, is still eligible for a 15-year restoration interval and 100 percent bonus depreciation. QIP applies to sure interior improvements made to nonresidential buildings and could be a priceless planning tool when QPP remedy is unavailable or when enhancements are made outdoors of production-related actions. A phase-out rule reduces the maximum Sec. 179 deduction if, during the yr, a taxpayer locations in service eligible assets in excess of $4 million.

This provision provides parity to Indian tribal governments, giving tribal governments the same ability as state governments to determine whether a baby has special needs for the needs of the adoption tax credit. Firstly, we’ll discover the “Changes in Tax Regulation for Depreciation in 2024,” setting the stage for understanding the broader implications of these adjustments. This foundational data is essential for businesses to align their strategies with the model new legal requirements. Following this, we delve into the “Impact on Tax Liability for Businesses,” the place Artistic Advising will highlight how adherence or non-compliance can significantly have an effect on a company’s monetary well being. If you actively participate in a rental property, you might have the ability to count the online rental earnings. If you file joint returns with your spouse, count each your corporation income and your spouse’s enterprise income (if any).

Irs Drafts Revision To Form W-9 For Taxpayer Identification Number Requests

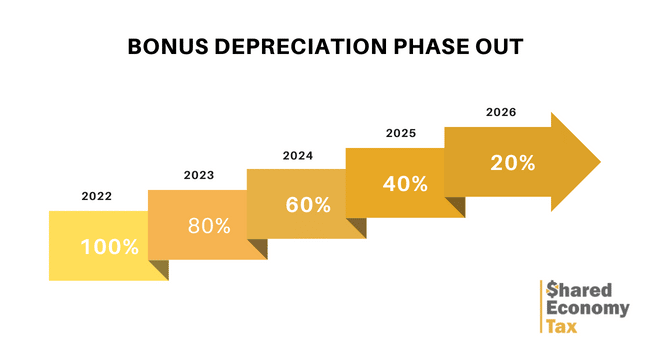

The excess business loss rule can have an result on individual taxpayers who have losses handed via to them from the forms of companies listed above. For 2025, an extra enterprise loss is the surplus of an individual taxpayer’s aggregate enterprise losses over $313,000 ($626,000 for a married joint filer). Any excess business loss is carried over to the next tax 12 months and can then be deducted beneath the foundations for NOL carryforwards. Beneath the Tax Cuts and Jobs Act (TCJA), 100% bonus depreciation was temporarily allowed for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023. Nonetheless, that proportion started phasing down in 2023 to 80%, with a plan to reduce back to 60% in 2024, 40 % in 2025, 20% in 2026, and eventually eradicated in 2027. The materials appearing in this communication is for informational functions only and should not be construed as advice of any type, including legal, accounting, tax, or investment recommendation.

The IRS has released a draft Kind W-9, Request for Taxpayer Identification Quantity and Certification, with modifications addressing digital asset dealer https://www.simple-accounting.org/ exemptions and reporting by sole proprietorships and disregarded entities.

Risk & It Compliance

The One Big Beautiful Bill makes the adoption tax credit partially refundable as much as $5,000 (indexed for inflation) beginning in taxable years starting after Dec. 31, 2024. Any carried forward amount can’t be used to calculate the refundable portion of the credit score in future years. If a qualifying car loan is later refinanced, interest paid on the refinanced quantity is usually eligible for the deduction. The Division of the Treasury and IRS issued steering that identifies 70 occupations of tipped employees and defines tips that are eligible for deduction. Moreover, the “Compliance Dangers for Companies Utilizing Outdated Depreciation Methods” shall be examined, underscoring the authorized and monetary perils that businesses would possibly face in the event that they lag in updating their practices.

One Big Lovely Bill Act Explained: New Tax Breaks, Deductions, And Guidelines For 2025

This blog breaks down what value segregation recapture is, the way it works, and what has changed (or stayed the same) beneath the OBBBA. If you are investing in commercial property, this is a critical piece of your tax planning puzzle. The permanent nature of this provision means you could make investment choices based mostly on business needs—not expiration dates. Miller Grossbard Advisors, LLP is an unbiased member agency of PrimeGlobal, an association of independent accounting companies. PrimeGlobal is one of the five largest associations of unbiased accounting firms on the earth, providing a wide range of instruments and sources to help member corporations furnish superior accounting, auditing, and management companies to purchasers across the globe. Treasury and the IRS perceive there might be challenges implementing the new legislation and have decided it’s within the interest of sound tax administration to provide limited penalty reduction related to remittance switch tax deposits.

With so many provisions packed into this bill, listed under are the most impactful modifications business house owners and high-income taxpayers ought to perceive and how they may form your planning in 2025 and beyond. Businesses that neglect to replace their depreciation strategies could inadvertently place themselves susceptible to non-compliance. This oversight can lead to extreme repercussions, together with audits, penalties, and interest payments on underpaid taxes. Artistic Advising understands that navigating the complexities of tax legislation may be daunting. Nonetheless, the results of utilizing outdated depreciation methods lengthen beyond financial penalties.

Funding advisory supplied via either Moss Adams Wealth Advisors LLC or Baker Tilly Wealth Administration, LLC. Under this strategy, construction is handled as having begun when the taxpayer has incurred (for an accrual-basis taxpayer) or paid (for a cash-basis taxpayer) a minimal of 10% of the entire cost of the property. Importantly, this calculation excludes the cost of land as properly as preliminary actions such as planning, design, and financing. Bonus depreciation was first launched in 2002, providing an additional first-year depreciation deduction equal to 30% of the adjusted foundation of certified property.

- Creative Advising works intently with purchasers to investigate the impression of these changes, making certain that their depreciation practices are aligned with the new legal requirements while also being tax-efficient.

- The enhancements to bonus depreciation broaden entry to the deduction, allowing extra companies to learn from elevated upfront tax savings in the years forward.

- As a outcome, a person taxpayer’s one hundred pc first-year bonus depreciation deduction can successfully be restricted by the surplus business loss rule.

- Earlier Than the OBBBA, nonresidential buildings usually needed to be depreciated over 39 years.

Now is the time to work carefully along with your tax advisor to evaluate your upcoming purchases, evaluate state-specific rules, and construct a proactive acquisition technique that aligns along with your long-term monetary goals. These modifications not only reduce the potential tax liability but in addition release money flow, making them a significant element of long-term enterprise progress and planning. At DHJJ, we’ve helped hundreds of businesses align their capital investments with evolving tax strategies, particularly when laws shifts unexpectedly. This article will break down the two revised depreciation incentives, highlight key planning concerns, and allow you to avoid the widespread pitfalls we’re already seeing with these new rules. Now, with the new legislation in place, companies can deduct 100% of the price of certified tools bought after January 19, 2025.

Bonus depreciation allows businesses to immediately deduct 100% of the price of eligible assets—such as equipment, tools, technology, and certain real property—rather than depreciating these belongings over multiple years. Beforehand set to section out under the Tax Cuts and Jobs Act, this deduction is now permanent under the new law. Take One Other LookThese are just a few of the key enterprise provisions introduced within the OBBBA. If you’re planning tools purchases, actual property enhancements, or capital investments in the subsequent 12–24 months, these depreciation incentives could considerably cut back your tax legal responsibility. We may help evaluate your options and structure purchases to take full benefit of the model new legislation in 2025 and past.